Tax Increment Financing (TIF)

What are Tax Increment Financing (TIF) Districts?

A tax increment finance district identifies a specific area based on the need for stimulated economic development, and then establishes a base taxable value for all properties within that boundary. Property owners within a TIF district have their property taxes above this base valuation assigned to be used to finance public improvements in the designated area. Each TIF district is created to provide local funds for community development, redevelopment, and revitalization, and the public improvements funded by a TIF should increase property values and expand the tax base within the district.

How can TIF funds be requested to support infrastructure expenses for development projects?

Requests for TIF funds follow an application process and require City Commission approval. The TIF application requires the entity seeking TIF funds to identify components such as the amount of funds being requested for each eligible infrastructure item, projected employment benefits created by the project, tax generation, project feasibility, the applicant’s capacity to complete the project, and timelines related to the proposed project. City staff reviews and analyzes the application, and presents the project to the Planning Advisory Board (or Downtown Development Partnership for the Downtown District), who then makes a recommendation to the City Commission. The Commission ultimately makes the final decision on whether or not TIF funds should be awarded. Tax Increment Finance funds should not be used on costs that were incurred prior to Commission approval.

What are Great Falls’ TIF Districts?

The City of Great Falls has two different types of TIF districts: Industrial and Urban Renewal. Industrial districts aim to attract and retain secondary value-adding industries. TIF funds that are granted within these industrial areas are used on improvements and infrastructure that support manufacturing developments.

Urban Renewal districts aim to eliminate blight. They are areas that have been identified as needing revitalization. TIF funds are used to build and support public improvements that will spur the elimination of blight and help redevelopment within the TIF District.

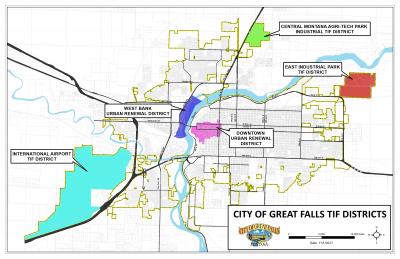

Where are the City’s TIF Districts?

Great Falls International Airport Industrial District

The Great Falls International Airport Authority has an interest in developing secondary, value-adding industries to improve the area's employment opportunities and expand the tax base. In 2008, this effort was recognized and facilitated through the creation of the Great Falls International Airport Industrial TIF District Plan that generally encompasses the entirety of the Airport property.

Central Montana Agri-Tech Park Industrial District

Another of the City’s industrial districts is the Central Montana Agri-Tech Park. The Central Montana Agri-Tech Park Industrial TIF District Plan was adopted in 2005, and identified Great Falls’ unique advantage in Agri-processing industries. Some of the developments existing within the District include ADF International, Malteurop, and Cargill.

East Industrial Park District

The third of the City’s Industrial TIF Districts is the East Industrial Park District. The East Industrial Park TIF District Plan is designed to incentivize the development of secondary, value-added industries, including manufacturing businesses that can take advantage of locating in a rail-served heavy industrial park location. Current businesses located in this TIF District include Helena Chemical, Inc., Montana Specialty Mills, and a Fed-Ex distribution facility.

Downtown Urban Renewal District

In 2012, the City created the Downtown Urban Renewal Plan that outlined the presence of blight in the Downtown, and pinpointed strategies to revitalize and redevelop the area. Through the creation of the TIF, and the continuous efforts of our Downtown partnerships, Great Falls has seen a vast improvement in our City’s core. On July 6, 2021, the City Commission adopted legislation to further increase redevelopment efforts in the Downtown TIF District. Specifically, the Commission adopted three building programs annually allocating up to $500,000 in TIF funds to assist downtown property owners in making permanent improvements to building facades, life safety code compliance improvements to address fire protection and ADA accessibility, and improvements involving lighting and security cameras to address Crime Prevention Through Environmental Design (CPTED). The City has created a separate Downtown TIF webpage that provides information regarding the approved building programs adopted by the Commission, which includes the TIF Building Program Application.

West Bank Urban Renewal District

The West Bank of the Missouri River in Great Falls has had a long history of industrial use, but as those industries moved farther from the west bank and the City center, redevelopment is necessary. In 2007, the West Bank Urban Renewal District Plan was adopted to transition the area for mixed-use redevelopment. Despite challenges of contamination clean up and blighted conditions, West Bank has new vitality.